THE COMPASS BIG PICTURE GETS BIGGER AND BETTER

It has been quite some time since my last Letter to Shareholders. Our exploration team has made tremendous progress over the past 15 months. As reported, we have discovered and defined several major gold-bearing structural trends within our permits, which have generated highly prospective target zones for bedrock drilling. The drilling that followed intersected exciting bedrock gold mineralization in numerous target areas. All of this was accomplished while carefully managing exploration capital to produce the maximum technical and economic benefit for each dollar spent.

As we look ahead to a work plan and budget for the remainder of the year, I would like to review what we have accomplished so far, what we have learned, and how we will apply that as we move forward. I also want to reaffirm our strategic focus and core objectives, which have not altered since we began our work together. We are determined to discover a gold resource of greater than 1 million ounces that can be mined as a low-cost, open pit deposit.

Maintaining Strategic Focus, Building on Consistent Exploration Success

Our strategy is clear and unwavering:

- acquire the largest, most prospective land package in the region;

- bring together the most experienced and successful exploration team with a proven track record of major discoveries;

- continually leverage the best available technology and knowledge to generate the most prospective targets on our +1,100 km2 permit package;

- on identified targets, test for near-surface gold with augur drilling down to the water table (15 – 20 m);

- based on auger results and other data, conduct bedrock drilling on best targets down to about 70 metres with AC and RC drilling;

- proceed to resource definition drilling when gold mineralization with sufficient grades, widths, and continuity is discovered;

- only raise capital periodically being mindful of the cost of capital and share dilution; and,

- capitalize on discovery, rather than development, through joint-ventures or outright sale.

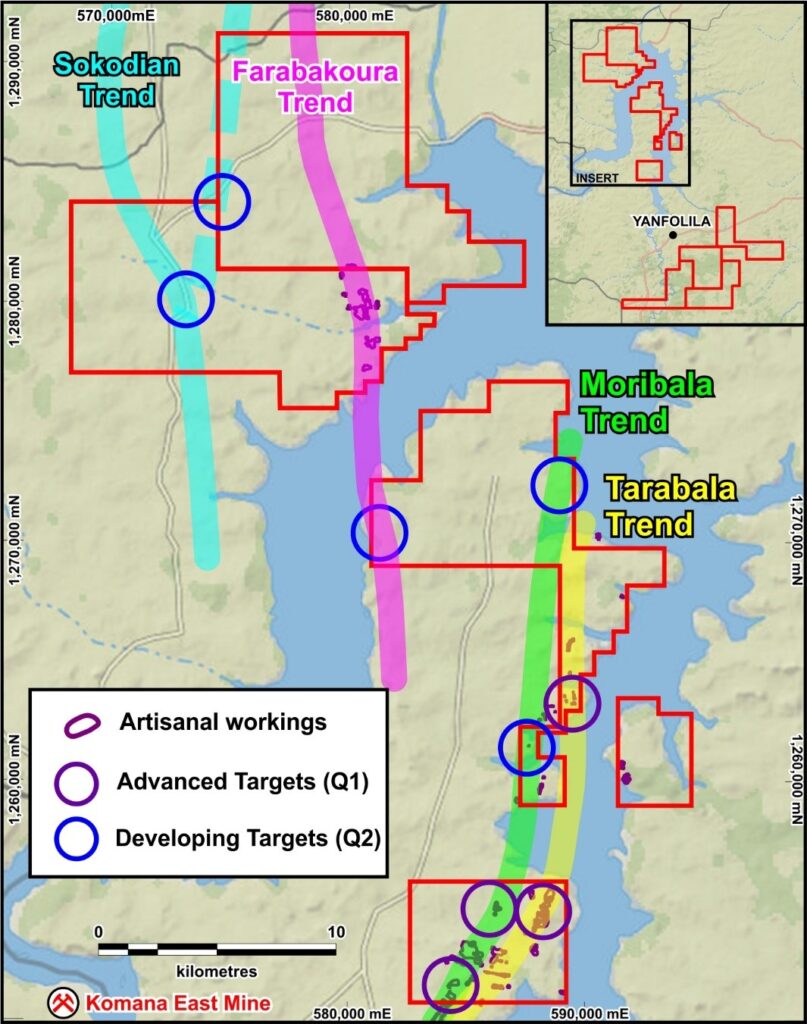

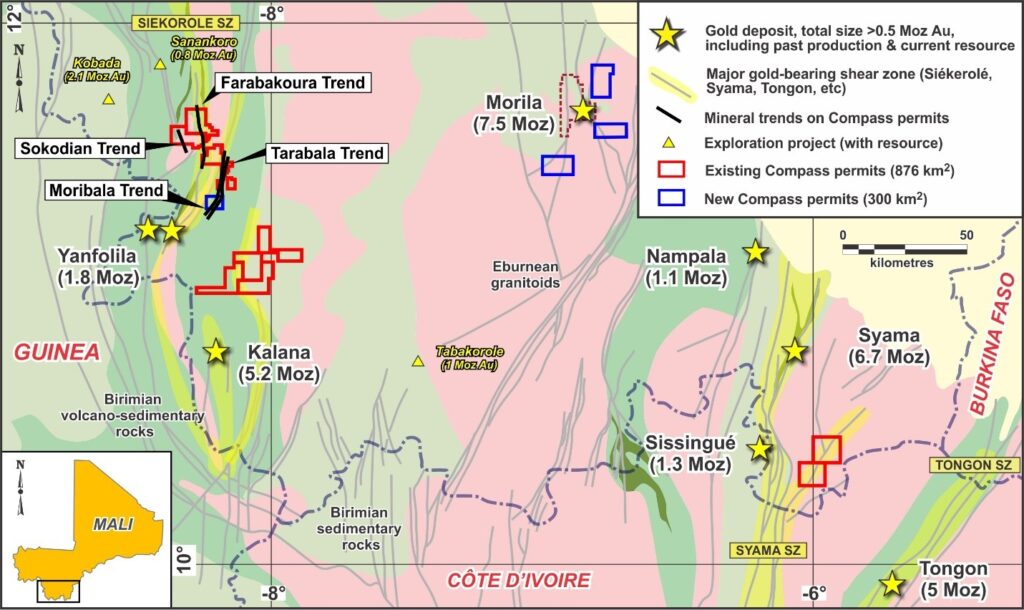

There is a good reason why every investor presentation we make includes this “Big Picture” slide. The Gold District of southern Mali continues to grow more and more exciting, with more production, exploration, and development occurring in this highly prospective area of roughly 300 km by 200 km. The structural trends within this small window host at least eight commercial deposits, several of which contain multi-millions of ounces of gold. Add to that, the several large resources discovered by international exploration groups, and there is just no question that we are in “elephant country.” We are also perfectly prepared to leverage our position for the benefit of us all. In our Exploration Manager, Dr. Madani Diallo, and his senior geologists, we have assembled an outstanding team of “elephant hunters” with decades of experience all across this region. In addition, Compass Gold maintains the exploration rights to one of the largest and most impressive land endowments of any group in this region, at almost 1,200 km2. And within just one portion of that endowment, we have discovered more than 40 km of highly prospective gold-bearing trends, as shown in greater detail below.

While this prolific gold district of southern Mali presents a tremendous opportunity for our Company, Mali is not without its challenges. The past two years have been difficult for our host country. With the Covid-19 pandemic came economic stress and extremist security threats in the northern regions have resulted in a military transitional government that is struggling to restore a stable democracy. Notably, several large mining companies operating in the area have reported that these issues have not impacted their operations. We are monitoring these circumstances, but so far, we have been able to conduct our work without interruption or unusual safety risks for our team.

This is the big picture, and it is important that we not lose sight of it, while we continue to narrow our focus.

The Compass Approach

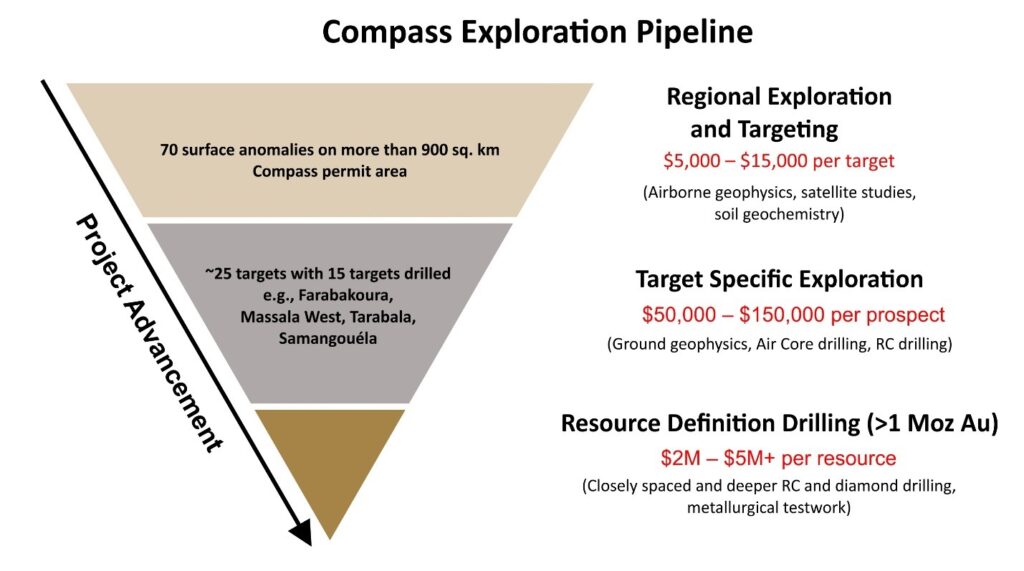

In order for a small company like ours to take on such a large collection of untested but highly prospective ground, it is essential that we apply a disciplined, technically-driven approach. We often remind our shareholders that we are committed to spending 90 cents of every precious dollar raised in the field on true exploration. Those exploration dollars are spent prudently, by using the most effective techniques for our environment to guide us in locating drill targets. It takes time and special expertise to process and interpret the data collected from airborne geophysics, on-the-ground Gradient IP surveys and tens of thousands of soil samples as we map hundreds of square kilometres of near-featureless ground in order to identify the dozens of drill targets large enough to host a commercial open-pit deposit.

Generating a drill target is a careful process of assessing multiple data points to identify the best places to start the drilling. The reality is that gold could be found at any point along those 40 kilometres of structural trends within our property. Eventually, the full extent of the structure may be drill tested, but our focus remains on those locations which represent the greatest likelihood of finding a near-surface deposit that can be developed into a profitable open-pit mine. Dr. Diallo and his team have been very successful at interpreting all the data we’ve collected to delineate the location, size and direction of several major structural trends running through our permit areas. Our team has demonstrated, through drilling at multiple target zones, that these trends host noteworthy concentrations of gold at less than 70 metres from the surface.

We have achieved an extraordinary success rate this past year, with 96% of our drill holes at the Tarabala prospect intersecting gold mineralization and nearly a 60% success rate at the concealed new Massala West prospect.

All of that successful drilling has affirmed our belief that along trends, such as the Tarabala Trend, a major gold deposit could be waiting to be discovered.

Following our Strategy and Sticking to our Objectives

At this point, I think it is worth explaining in some more detail, our Strategy and Core Objectives, which we apply in selecting targets and work priorities. We are completely focussed on discovering a gold deposit of at least 1 million ounces, located near-surface (less than 70 metres depth) and suitable for open-pit mining. Why? Because in this gold district, there are many such mines, with gold grades averaging 1.5 grams per tonne and as low as 0.5 grams per tonne, which have been operating profitably, at gold prices much lower than they are today. That cannot be said of any other gold district in the world.

Compass has strictly focussed on target zones along known structures that are at least 750 metres long and 20 metres wide—large enough to host a multi-million-ounce deposit. We drill these targets to depths of about 70 metres using Air Core (AC) and Reverse Circulation (RC) drilling because they are both quick and cost-effective. When we intercept interesting gold mineralization—that is, with grades greater than 1.0 gram per tonne or widths greater that 15 metres, as we found at Farabakoura and the Tarabala prospects—we go back in with closer spacing of drill holes.

We look for a combination of the right grade, and width along sufficient strike length. Importantly, we also want to know whether these are continuous or if there are gaps within the zone. In most cases, we find that the target zone is “open at depth”, which means we expect that there has been a gold mineralizing event that occurred below the 70-metre deep target zone, which hosts still more gold. However, drilling to these deeper depths, particularly with diamond drilling, is much more expensive and may be less predictable in hitting the mineralized structure.

In the case of Farabakoura and our two zones on the Tarabala Trend, we have shown significant gold grades and widths in near-surface sections. Our initial follow-up drilling to test continuity on those targets and some deeper holes returned good results which our team has assessed. We have deferred further deep drilling on those targets. Have we walked away from Farabakoura and Tarabala? Absolutely not. They represent real value and opportunity which could be realized down the road. They will require deeper and more expensive drilling to be fully tested, and so, fall outside of our current exploration goal of first identifying open-pit potential.

As we continue our progress, we continue to gather more valuable data and apply what we learn from our success on those targets in order to generate several additional targets that even better fit our strategy and budget. From a practical point of view, we are able to drill three or four target zones, along the same structures, defined by the same high probability indicators, (strong Gradient IP features, shallow soil gold anomalies, good auger drilling results, and nearby active artisanal mining) for roughly the same cost it would take to mount a deeper drilling program to a depth of 150 metres at one of those previous target zones.

So, for now, we have “parked” the Farabakoura, Massala West and Tarabala prospects. I am confident that there will be a time when we have a greater budget, a better cost of capital, or maybe a joint-venture partner, when those areas will be the subject of further work.

With a large land package such as ours, the potential for attractive partnerships and joint ventures is something we are always considering. The original $2 million investment by SEMAFO, now held by Endeavour Mining, is just one example of this ongoing strategy

For now, we continue to look for that first target zone that will produce the grades, widths, strike length AND continuity to form the anchor deposit of a commercial gold mine.

The exciting fact is that our team continues to identify multiple target zones along these proven trends, and our acquisition of the Moribala permit areas has added 12 kilometres of these highly prospective structures to our property endowment. Fortunately, our highly-experienced technical team on the ground saw the potential at Moribala when others did not, and we were able to apply to the Mining Ministry to have a new permit issued to Compass on this available ground. We have already identified five target areas within our new permit, and recently began shallow AC drilling at two of these target areas. This work will take us through to the end of March. For the remainder of the year, Dr. Diallo and our Technical Director Dr. Sandy Archibald have put forward a budget for our shareholders to consider. In keeping with our promise, roughly 80% of any budget will be focussed on drilling precisely along those proven trends and on those target zones where we see the greatest probability of achieving our objectives.

On a separate front, we have also announced the recent acquisition of rights to several properties around the Morila gold mine. This addition to our endowment reflects the fact that, in line with our core objective of finding the most prospective ground, our property package is an evolving pipeline of opportunities. The Morila blocks and even the addition of the Moribala permit simply demonstrate the ability of our team to recognize the geological potential in new areas and to work effectively to secure ground that can add value for our shareholders in the future. The most enticing aspect of the Morila blocks is that our team has extensive knowledge and experience in this area based on their prior direct involvement with the discovery of the 7.5-million-ounce Morila deposit. Such an opportunity would easily be the focus of a separate company, but we have been able to bring it into the fold and start some preliminary target generation work which may lead to drilling, and hopefully, a discovery down the road.

Some Final Thoughts

As I look back on all we’ve done over these past few years, it has never been clearer that we have the right team, in the right place, executing the right strategy to return excellent value to our shareholders. Every step of the way, we have gone about our work with technical discipline and prudent financial control, and we have found gold in each and every area we have drilled.

We have also been strategic in adding to our land holdings when our exploration results have revealed extensions of trends and mineralized zones that could be secured along our original boundaries. That was the case when we added the Sankarani East permit, and more recently, the Moribala permit.

As a team, we have been consistent and persistent, while you, as shareholders, have been very patient. We sincerely appreciate your support.

I do understand that it can be difficult to follow the steps we are taking as we plot out new names and locations in technical press releases that do not fully explain, in narrative form, how each step fits into our stated strategy. We need to do a better job of taking the conversations we have internally and reflecting those insights and explanations into every communication and presentation we produce, and we will.

What should be clearly understood is that the Compass team has made tremendous strides since acquiring our original exploration permits. The hundreds of square kilometers we have covered with geophysical surveys and surface sampling have generated dozens of strong near-surface anomalies and more than a dozen bedrock drilling targets. Within the current drill target areas and those not yet drilled, we have an abundance of exciting opportunities to achieve our objectives.

If we had our choice, our drilling would have produced a deposit that ticked all the boxes by now—but we know that is not how grassroots exploration works. The path to the end zone is not always a straight line and there is no game clock. However, the fact is, we have never been in a stronger position than today to achieve our objectives.

Once again, thank you for your support and we look forward to a successful year ahead.

Sincerely,

Larry Phillips

President & CEO

Compass Gold Corporation