Toronto, Ontario, January 5, 2023 – Compass Gold Corp. (TSX-V: CVB) (Compass or the Company) announced today that it has completed its previously announced private placement financing and is preparing to launch a follow-up drilling program to test previously identified mineralized sections at depth along the Tarabala Trend on its Sikasso Property in Southern Mali (Figure 1).

Highlights

- Closed previously announced private placement financing for gross proceeds of $700,000

- Field teams to be mobilized to prepare drill pads for follow-up deeper drilling at the Tarabala prospect, including where metallic screen fire assaying reported 7 m at 14.13 g/t Au

- Drilling will include 2,000 m reverse circulation (RC) and 600 m diamond core drilling

- Focused on tracing the down-dip extension of wide zones of gold mineralization identified by earlier drilling campaigns and verifying the gold content using metallic screen fire assay

Compass CEO, Larry Phillips, commented,“With the closing of our recent financing, we are initiating our planned follow-up drilling program at Tarabala. Previous drilling indicated gold mineralization in a wide zone extending over a strike length of 1,600 metres at shallow depths. However, as we’ve also noted, re-assaying of previous RC and core samples demonstrated that simple fire assay testing had under-reported the gold content of the samples primarily due to the presence of the “nugget effect” from coarse gold. Once the new drill pads are prepared, and a drilling contract is finalized, we expect to begin drilling in early February.”

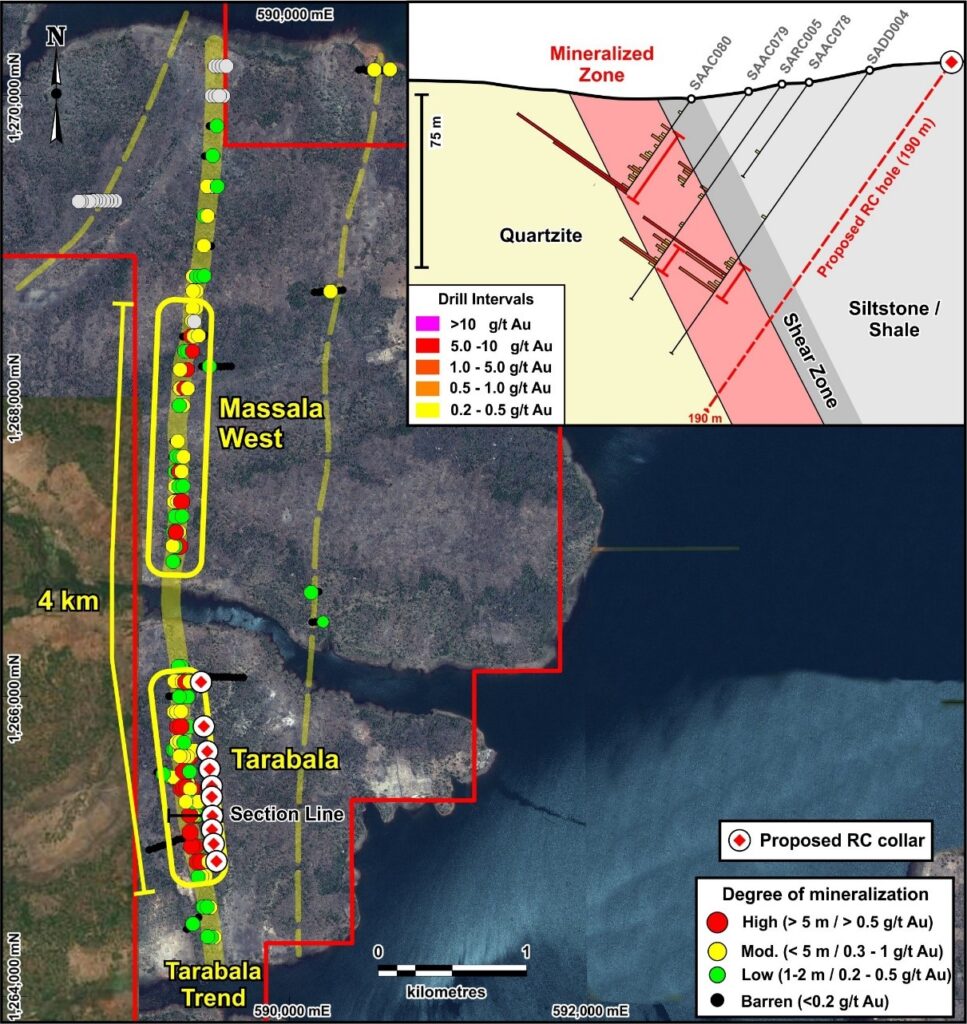

Compass Exploration Manager, Dr. Madani Diallo, added, “The upcoming drilling at our highly-prospective Tarabala prospect will provide important new information on the nature and grade of the gold mineralization. The new drill holes will be deeper than the previous drilling and we will use metallic screen fire assay to ensure the coarse (nuggety) gold content is recorded. Drilling will establish the width and orientation of the veins, mineralogy, as well as the continuity of grade along strike and down dip. While we know gold mineralization extends over 4 km along the Tarabala fault between the Tarabala and Massala West prospects, we also need to determine the depth potential.”

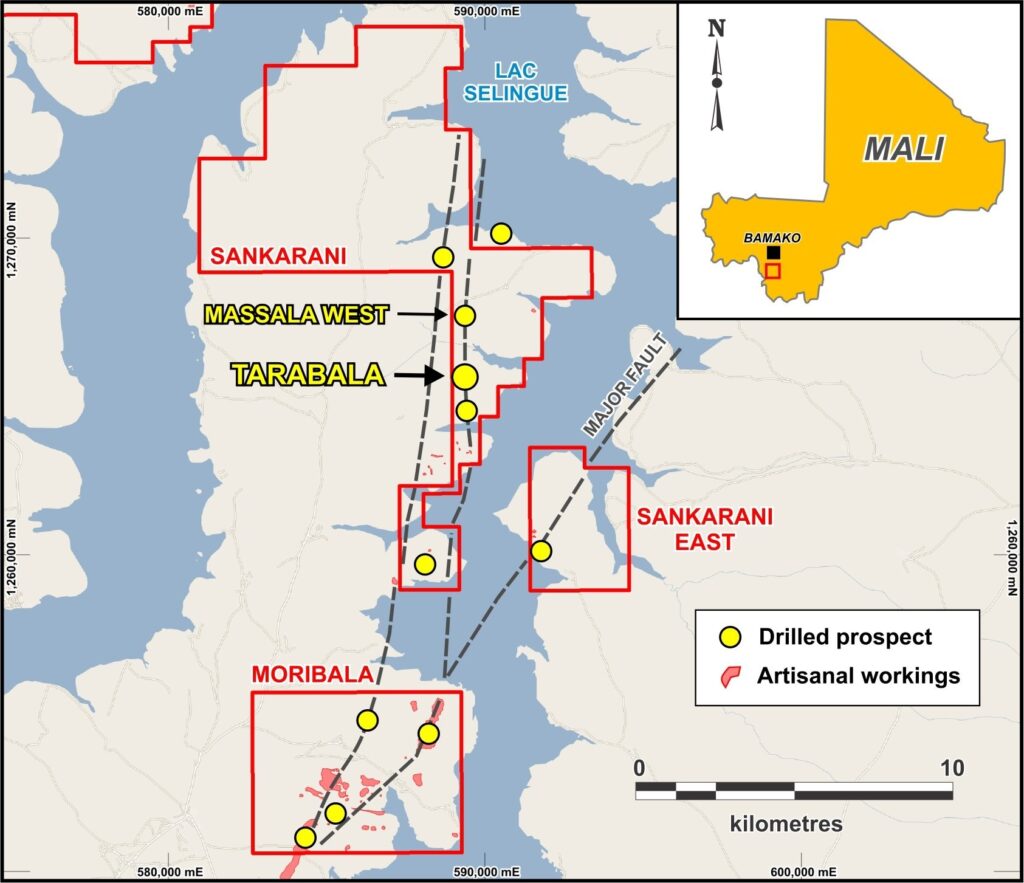

Figure 1: Property map showing the location of the Tarabala prospect.

Next Steps

A 2,000-m RC drilling program at the Tarabala prospect (Figure 2) is planned to begin in early February, 2023. Drilling will focus on determining the nature of the gold-bearing quartz veins (width, grade, orientation, and mineralogy) at depths of up to 200 m from surface. Based on previous drilling results from the prospect (see Compass news releases dated January 20, May 18, and December 6, 2021) and initial results from the new RC drilling (e.g., presence of quartz veining), an additional 600 m of diamond drilling will take place in March 2023. Results of the RC drilling should be available in March. This information will be used to plan a potential resource definitional drilling program in Q2 2023, with the objective of defining a maiden resource.

Figure 2: Summary drilling results on the Tarabala Trend and the location of the planned RC drill holes.

Results from Previous Drilling

Air Core (AC) drilling on the Tarabala Trend first identified bedrock gold at the Tarabala prospect in April 2020. Subsequent drilling identified shallow gold mineralization at Massala West, a distance of 4 km (Figure 1). To date, a total of 106 AC holes (5,547 m), 5 RC holes (530 m), and five diamond hole (563.6 m) have been drilled at Tarabala over a distance of 1.5 km, and 102 AC holes (6,035 m) and 11 RC holes (1,056 m) at Massala West over 3 km.

AC results at Tarabala included wide intervals up to 16 m @ 1.51 g/t Au (from 16 m; SAAC02) and 17 m @ 0.73 g/t Au (from 18 m; SAAC109). They also included higher grade sub-intervals such as 4 m @ 5.20 g/t Au (from 26 m; SAAC02) and 1 m @ 12.99 g/t Au (from 33 m; SAAC36). Follow-up RC drilling at Tarabala in December 2020 and February 2021 indicated that the mineralization continued at depth, but it was not tested deeper than 60 m from surface. The widest intercepts from the RC drilling were 26 m @ 0.47 g/t Au (from 45 m; SARC001) and 25 m @ 0.58 g/t Au (from 67 m; SARC003). Diamond drilling results (see Compass press release Dec 6, 2021) confirmed the presence of narrow quartz veins over broad intervals (e.g., 32 m @ 0.33 g/t Au, SADD003) and narrower, higher-grade zones such as 17 m @ 0.96 g/t Au (including 3 m @ 3.36 g/t, SADD004). The best mineralization was identified in a 1-km section of the 2.2-km-long mineralized Tarabala Fault.

Recent re-analysis of some of the diamond drill core (see Compass release December 22, 2022) using metallic screen fire assay showed that earlier analysis had underreported gold content in many samples due to the nugget effect. For example, exceptionally high gold grades were recorded in diamond drill hole SADD001 from 109 to 116 m: 7 m @ 14.13 g/t Au (metallic screen fire assays) versus 7m @0.424 g/t Au (original fire assay). The new assaying was highly influenced by one sample that contained 97.34 g/t Au. To ensure the most reliable assay results, the new drilling at Tarabala will be analyzed using metallic screen fire assay.

At Massala West, two kilometers further north, AC drilling identified two discrete mineralized zones greater than 550 m. The northernmost zone contained the widest mineralized interval and the highest grade. Drill hole SAAC123 returned 24 m @ 2.35 g/t Au (from 18 m), which included 1 m @ 26.80 g/t Au (from 35 m). RC drilling in the two zones identified several mineralized intervals, including 6 m @ 1.02 g/t Au (from 43 m; SARC010). If deeper drilling at Tarabala continues to be as encouraging, additional drilling will be performed.

Closing of Private Placement Financing

The Company has issued a total of 10,000,000 common shares of the Company, at a price of $0.07 per share, for aggregate gross proceeds of $700,000 pursuant to the closing of its previously announced private placement (the “Offering“) (see Compass news release dated November 18, 2022).

In connection with the Offering, the Company has paid a cash finder’s fee of 3% on a portion of the Offering, totalling $6,000 in aggregate subject to compliance with the policies of the TSX Venture Exchange and applicable securities legislation.

Insiders of the Company purchased an aggregate of 2,782,285 shares under the Offering, for aggregate consideration of $194,760. Such participation is considered a “related party transaction” within the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). Participation by insiders in the Offering was exempt from: (i) the valuation requirements of MI 61-101 by virtue of the exemption contained in Section 5.5(b) of MI 61-101, as the Company is listed only on the TSX Venture Exchange; and (ii) the minority shareholder approval requirements of MI 61-101 by virtue of the exemption contained in Section 5.7(1)(a) of MI 61-101, as at the time the Offering was agreed to, neither the fair market value of the subject matter, nor the fair market value of the consideration for, the Offering, insofar as it involved interested parties, exceeded 25% of the market capitalization of the Company.

All shares issued pursuant to the Offering are subject to a hold period expiring four months and one day after the date of issuance. The Offering is subject to final acceptance by the TSX Venture Exchange.

The securities offered pursuant to the Offering have not been registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons absent registration or an applicable exemption from registration requirements. This release does not constitute an offer for sale of securities in the United States.

About Compass Gold Corp.

Compass, a public company having been incorporated into Ontario, is a Tier 2 issuer on the TSX- V. Through the 2017 acquisition of MGE and Malian subsidiaries, Compass holds gold exploration permits located in Mali that comprise the Sikasso Property. The exploration permits are located in three sites in southern Mali with a combined land holding of 1,143 sq. km. The Sikasso Property is located in the same region as several multi-million-ounce gold projects, including Morila, Syama, Kalana and Komana. The Company’s Mali-based technical team, led in the field by Dr. Madani Diallo and under the supervision of Dr. Sandy Archibald, P.Geo., is conducting the current exploration program. They are examining numerous anomalies first noted in Dr. Archibald’s August 2017 “National Instrument 43-101 Technical Report on the Sikasso Property, Southern Mali.”

Qualified Person

This news release has been reviewed and approved by EurGeol. Dr. Sandy Archibald, P.Geo, Compass’s Technical Director, who is the Qualified Person for the technical information in this news release under National Instrument 43-101 standards.

Forward‐Looking Information

This news release contains “forward‐looking information” within the meaning of applicable securities laws, including statements regarding the Company’s planned exploration work and use of proceeds of the Offering. Readers are cautioned not to place undue reliance on forward‐looking information. Actual results and developments may differ materially from those contemplated by such information. The statements in this news release are made as of the date hereof. The Company undertakes no obligation to update forward‐looking information except as required by applicable law.

For further information please contact:

| Compass Gold Corporation | Compass Gold Corporation |

| Larry Phillips – Pres. & CEO | Greg Taylor – Dir. Investor Relations & Corporate Communications |

| lphillips@compassgoldcorp.com | gtaylor@compassgoldcorp.com |

| T: +1 416-596-0996 X 302 | T: +1 416-596-0996 X 301 |

Website: www.compassgoldcorp.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.