| Population | 19.66 Million (2019) |

| Language | French |

| Independence Year | 1960 |

| Capital | Bamako |

| Currency | CFA Franc BCEAO |

| GDP | US$ 17.51 Billion (2019) |

| GDP per Capita | US$ 891 (2019) |

| Land Area | 1,240,192 km2 |

| Water Area | 20,002 km2 |

| Neighbouring Countries | Niger, Algeria, Burkina Faso, Senegal, Mauritania, Guinea, Cote D'Ivoire |

Mining laws in Mali are based on the French legal framework. Gold extraction has occurred in this West African country since ancient times using simple implements before the modern mechanized system came into practice. This activity is traced to the days of monarchy of the Islamic emperors in the country when salt and gold were major Trans-Saharan trade commodities from Timbuktu and Djenné.

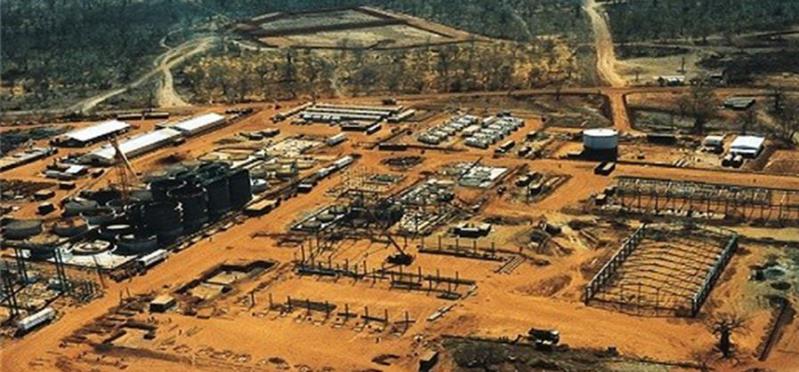

The West African country of Mali is Africa’s third largest gold producer, with more than a dozen mines operated by multinational companies. Major investors in Mali’s gold sector include AngloGold Ashanti, B2 Gold, Firefinch, Hummingbird, IAMGOLD, Robex and Resolute.

Mali’s mines ministry estimated that industrial gold production was estimated at 65.2 tonnes in 2020, slightly higher than the previous year’s record production of 65.1 tonnes.

Production had been forecast at 59.7 tonnes, but surpassed expectations for the second year in a row due to improved technical performance by mining companies, according to the head of Mali’s mines division.

Mali’s total gold output for the year was about 71.2 tonnes. This includes about 6 tonnes of gold produced by artisanal miners, which is sharply down from the estimated 50 tonnes they produced in 2017.

Industrial production is expected to increase further in 2021, although no official forecasts are currently available.

Earlier government estimates indicated that Mali contains approximately 800 tonnes of gold reserves.

Government records indicate that gold mining in Mali represents as much as 70% of export earnings and about 8% of Gross Domestic Product (GDP).

Mali’s Minister of Mines, Prof. Tiémoko Sangaré, has noted: The stability of the tax and customs regime offering actors to migrate to a more favorable;

- The agreement issued for a period of 30 years;

- Free choice of suppliers and subcontractors for the acquisition of goods and services;

- The free importation of goods, materials, equipment, machinery, spare parts and consumables, subject to compliance with the Code customs officer;the free movement in Mali of all materials and goods and all substances and products derived from research and exploitation;

- Free conversion and transfer of funds to pay debts (principal and interest) in foreign currency vis-à-vis foreign creditors and suppliers;

- Free conversion and free transfer of net profits to non-WAEMU countries and all funds allocated to the amortization of loans obtained from non-Malian institutions and subsidiaries of the incumbent after the payment of all duties and taxes provided for by the Malian law;

- Free conversion and transfer of profits and liquidation fund after payment of taxes and customs duties under Malian law;

- The choice of the arbitration procedure for the resolution of disputes.”